How can Ready for Brexit help you?

We can help you redesign your business model and survive Brexit.

Our consulting team have personal experience of operating before the Single Market and Customs Union began.

The Use of Payday Loans During Brexit

Many company have reported needing to use payday loans because of Brexit. We would recommend Wage Day Advance if you do you need to use a payday lender. They can approve loans within an hour and cash paid out the same day.

We can help with the key issues:

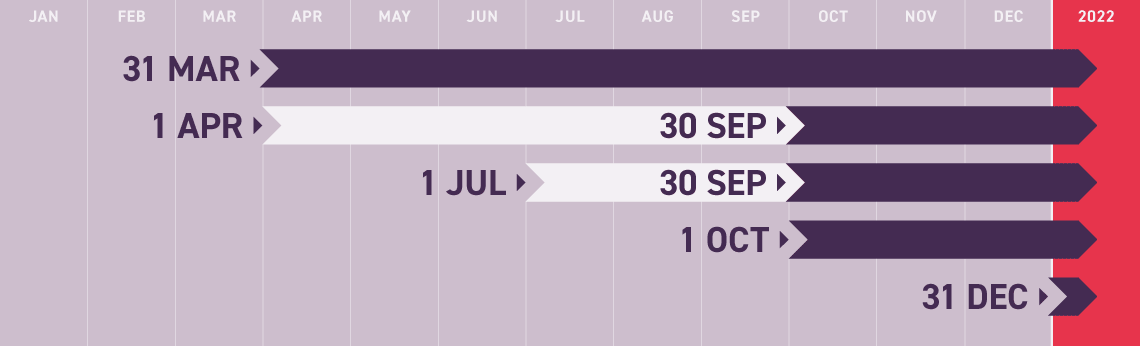

2021 Key Brexit Dates

31 MAR

(Unresolved)

NOW 2022

Memorandum of Understanding for cooperation on financial services due

30 SEP

WAS 1 APR

NOW 2022

Grace period for GB-NI agri-food safety paperwork ends

30 SEP

WAS 1 JUL

NOW 2022

Grace period for GB-NI trade of chilled meat products ends

1 OCT

UNRESOLVED

NOW 2022

UK-EU border controls start to be progressively introduced

31 DEC

UNRESOLVED

NOW 2022

EU regulations on flow of GB-NI medicines enter into force